Money is a topic that evokes various emotions and beliefs, often shaped by societal norms, personal experiences, and cultural influences. However, not all commonly held beliefs about money are accurate or beneficial. In fact, some myths about money can hinder financial success and prevent individuals from achieving their financial goals. In this blog, we’ll debunk five common myths about money that you should not believe, providing you with clarity and empowering you to make informed decisions about your finances.

Myth 1: “More Money Equals More Happiness”

While financial stability can contribute to overall well-being and security, the belief that more money automatically leads to greater happiness is a myth. Numerous studies have shown that once basic needs are met, additional income has diminishing returns on happiness. Instead of chasing after wealth for the sake of it, focus on cultivating meaningful experiences, relationships, and personal growth, which are more likely to bring lasting happiness and fulfillment.

Myth 2: “I Don’t Need to Budget If I Have a Good Income”

Regardless of your income level, budgeting is a fundamental financial tool for managing your money effectively. Without a budget, it’s easy to overspend, accumulate debt, and lose track of your financial goals. Budgeting allows you to track your expenses, prioritize your spending, and allocate funds towards savings, investments, and debt repayment. No matter how much you earn, creating and sticking to a budget is essential for achieving financial stability and success.

Myth 3: “Investing Is Too Risky”

While investing does involve a certain level of risk, avoiding it altogether can be even riskier in the long run. Inflation erodes the purchasing power of your money over time, so keeping all your savings in cash can actually lead to loss of value over the years. By diversifying your investments and adopting a long-term perspective, you can mitigate risk and potentially earn higher returns than keeping your money in low-yield savings accounts. Educate yourself about different investment options and consult with a financial advisor to develop a strategy that aligns with your risk tolerance and financial goals.

Myth 4: “I’ll Start Saving When I Earn More Money”

Waiting for the perfect moment to start saving is a common trap that many people fall into. However, the truth is that saving is a habit that can be developed regardless of your income level. Start small by setting aside a portion of your income each month, even if it’s just a few dollars. Automate your savings by setting up regular transfers to a savings account or retirement fund, and gradually increase your contributions as your income grows. The key is to prioritize saving and make it a non-negotiable part of your financial routine, regardless of how much you earn.

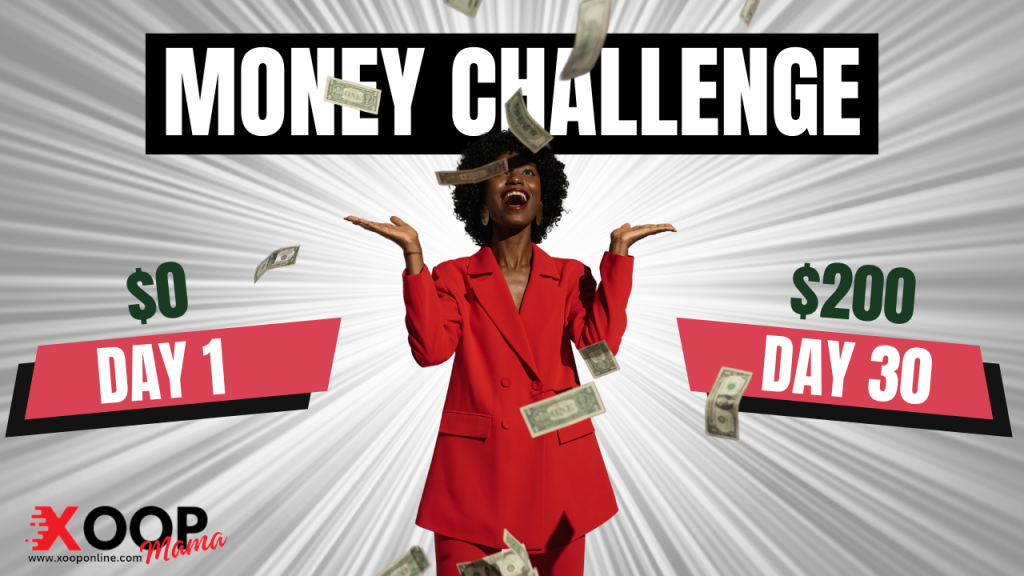

Try this 30 day Challenge by downloading our Free Money chart. It’s pretty simple.

Step 1: Print out the table

Step 2: Get a Money Jar

Step 3: Each day save the lose change you have in your pockets or purse. Make an X over that amount on the chart

In 30 days you WILL reach your goal of $200.00 Let us know how you did

Myth 5: “Debt Is a Normal Part of Life”

While debt may be common in today’s society, it’s not necessarily a normal or desirable part of life. Carrying high-interest debt can significantly impact your financial well-being and limit your options for the future. Instead of accepting debt as inevitable, focus on paying down existing debt as quickly as possible and avoiding unnecessary debt in the future. Adopting a frugal lifestyle, increasing your income, and prioritizing debt repayment can help you break free from the cycle of debt and achieve financial freedom.

…”Study how to do the most good and let the pay take care of itself.” ~ Lyman Abbott

Conclusion

By debunking these five myths about money, you can gain a clearer understanding of personal finance and make more informed decisions about your financial future. Remember that financial success is not determined by the size of your income or the amount of money you have, but by your mindset, habits, and willingness to take control of your finances. By challenging common myths about money and adopting smart financial practices, you can build a solid foundation for long-term financial stability and success.